Content courtesy of Vanguard. Authors are Francis M. Kinniry Jr., CFA, Head of Investment Advisory Research Center, Ted Dinucci, CFA, Senior Research Specialist, Investment Advisory Research Center and Chris Tidmore, CFA, Senior Manager, Investment Advisory Research Center.

In investing, it’s common to hear warnings of bubbles and impending bear markets. Some businesses are incentivized to grab your attention by capitalizing on known investor fears and loss-aversion tendencies. Together, these can lead to short-term actions that go against long-term objectives.

To be clear, it has been very hard to know what the future will hold for the markets. At some point, there will inevitably be another bear market, and those calling for it may seem prescient. However, many fail to consider the full holding period returns in their evaluation; in other words, the market’s return from the rise of bear market sentiment, through the bear market, and subsequent recovery. If history and our research are any guide, the headlines will likely prove premature, and staying the course is likely to be a better solution than trying to time markets.

Thus, the question should not be, “Are we on the eve of a bear market?” because the answer to this will only be known in hindsight. Instead, the questions should be, “Do I have the right financial portfolio that aligns to my goals, risk preferences, and time horizons to harness market risk premiums?” and, “should the market drop 20% to 50%, are we certain that we would rebalance?” If the answers to these questions are “yes,” then tuning out the noise, staying invested, and focusing on long-term goals has proven to be a winning strategy.

The rewards of staying invested

Despite bear markets and episodic spikes in volatility, U.S. equities have proved resilient throughout history, delivering strong long-term returns. For instance, Figure 1 shows that, since June 1996 (the year “irrational exuberance” became the talk of the town), equities have returned +9.7% annualized (+1,218% cumulative)!

While this period captures one of the most impressive bull markets in history, it also includes a global pandemic and five bear markets with drawdowns ranging from –20% to –55%.

Over this 25+ year period, one could always find media commentary of “irrational exuberance,” “bubbles,” and “below-average return expectations for stocks.” While difficult, investors who were able to tune out the noise and stay invested have been rewarded again and again.

So far, 2024 is no different. The U.S. equity market has reached a new high 19 times this year and is on pace to post about a 9% gain for the quarter, while broad taxable and tax-exempt fixed income are down 0.9% and 0.3% respectively.(Footnote 1) Moreover, since the lows from October 14th, 2022, equities have returned +47% and are now 10% above their January 2022 high.

Figure 1: The benefits of staying invested compound over time

Annualized return of U.S. stocks through bull and bear markets

Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. Notes: U.S. stocks as represented by the S&P 500 Index from June 1, 1996, to December 31, 1998; Dow Jones Wilshire 500 Index from January 1, 1999 to April 22, 2005; MSCI US Broad Market Index from April 23, 2005 to June 2, 2013; and CRSP US Total Market Index thereafter. Bear market dates include: July 1998 to August 1998, September 2000 to February 2003, November 2007 to February 2009, February 2020 to March 2020, January 2022 to September 2022. Bull markets include all other periods between June 1996 to March 22, 2024, that were not identified as being a bear market.

Sources: Vanguard Investment Advisory Research Center analysis using data from FactSet and Morningstar, Inc. Data as of March 22, 2024.

Figure 2: Don’t let headlines and short-term performance scare you out of the market

Probability that stocks had positive performance over the next one, two, and four quarters given negative or positive returns over the prior one-, two-, and four-quarter periods

Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: U.S. stocks as represented by the S&P 500 through 1970; Wilshire 5000 from 1971 through April 22, 2005; MSCI US Broad Market Index through June 2, 2013; CRSP US Total Market Index thereafter.

Source: Vanguard Investment Advisory Research Center analysis using data from FactSet and Morningstar, Inc. Data as of March 22, 2024.

Always be prepared for volatility

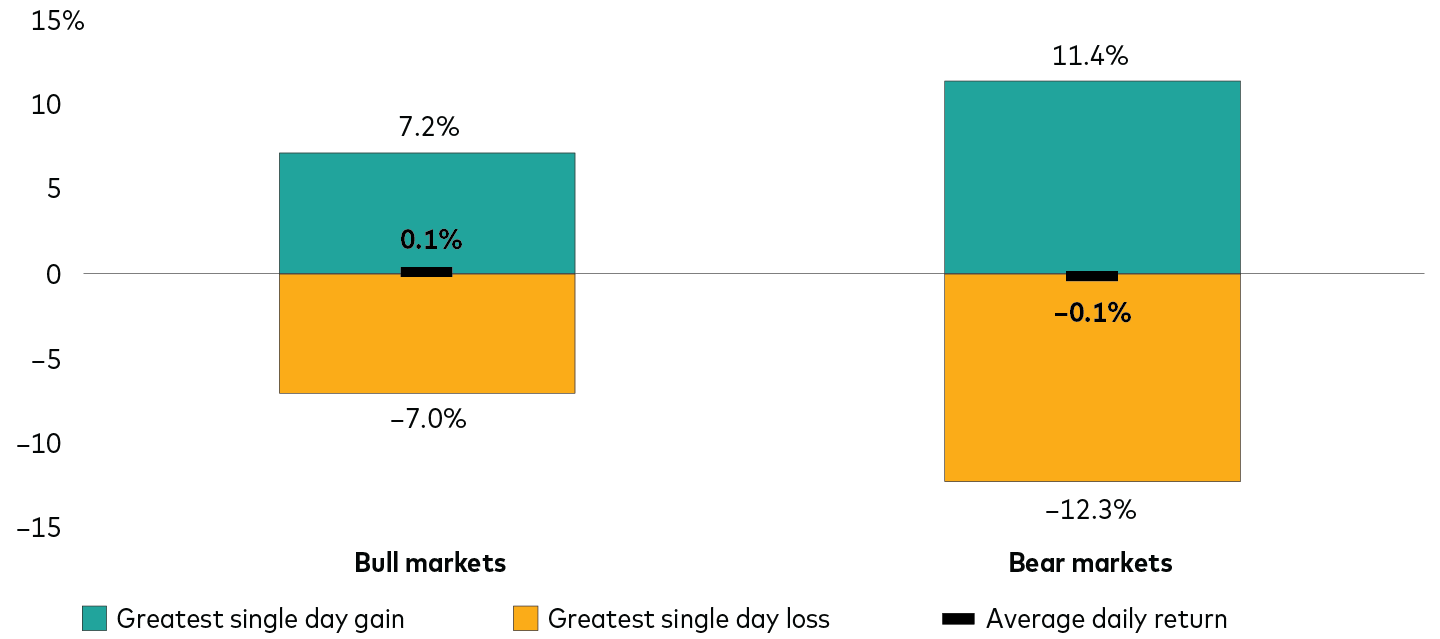

Again, accurately predicting when the next bear market will occur has been highly elusive. However, when an eventual bear market does occur, it’s reasonable to expect extreme two-way volatility (for example, strong positive and negative returns). Figure 3 helps bring this to life by highlighting the greatest single-day gains, losses, and average daily returns during equity bull and bear markets.

Here, you can see that stocks can always experience aggressive moves up or down. However, during bear markets, such moves are even more acute with daily returns ranging from +11.4% to –12.3%, versus +7.2 to –7.0% in bull markets. That’s more than a 65% increase in the level of variability!

Unfortunately, these bouts of extreme volatility and the clustering of the best and worst days has crucial long-term investment implications that we’ll discuss next.

Figure 3: Bear markets bring the best of times and the worst of times

Range of daily stock returns during bull and bear markets

Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: U.S. stocks as represented by the S&P 500 Index from June 1, 1996, to December 31, 1998; Dow Jones Wilshire 500 Index from January 1, 1999, to April 22, 2005; MSCI US Broad Market Index from April 23, 2005, to June 2, 2013; and CRSP US Total Market Index thereafter. Bear markets dates include July 1998 to August 1998, September 2000 to February 2003, November 2007 to February 2009, February 2020 to March 2020, January 2022 to September 2022. Bull markets include all other periods between June 1996 to March 22, 2024, that were not identified as being a bear market.

Source: Vanguard Investment Advisory Research Center analysis using data from FactSet and Morningstar, Inc. Data as of March 22, 2024.

Know the power of having a plan and sticking to it

A financial plan that is well-balanced; aligned with your time horizon, investment goals, and risk tolerances; and strategically followed and rebalanced has proven to be a successful investment strategy. The challenge, most often, is staying with the financial plan when experiencing extreme bull and bear markets. Sticking with the financial plan sounds easy, especially when markets are doing well, but it is extremely challenging during market sell-offs, even for the most experienced investors and advisors.

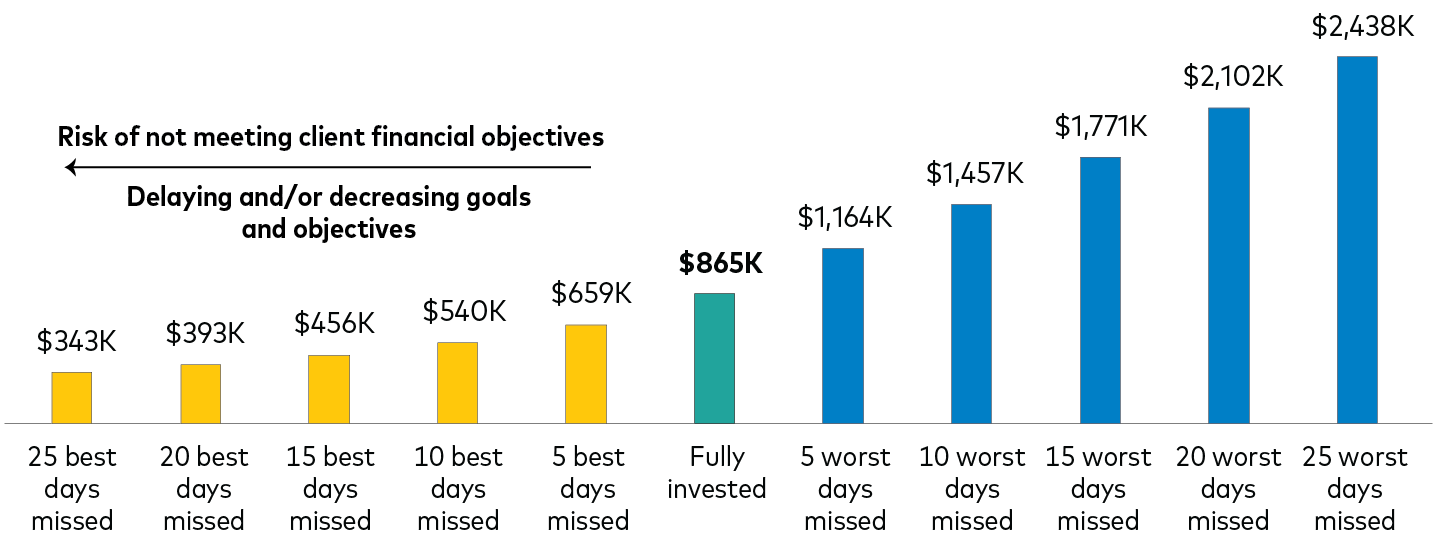

For instance, Figure 4 shows that an investor with an initial $100,000 investment in a 60/40 (stock/bond) portfolio would have seen their balance grow to $865,000—assuming no additional cash flows, fees, or taxes (not many investors would turn down 8.6X more wealth over a roughly 28-year period). It is critical to remember this period included a global pandemic and five bear markets with drawdowns ranging from –20% to –55%.

However, looking at the dispersion of wealth in Figure 4 shows that investors not having the mental fortitude or help of an advisor to keep them from trying to time the market could materially impact their ability to meet their long-term financial goals. Financial plans using a goals-based framework—based on expected probabilities of meeting their client’s long-term investment goals and objectives—lose their efficacy when you introduce such significant dispersion due to market timing. Even if that timing is only for a few days, weeks, or quarters.

As shown, a 60/40 portfolio that missed the 25 best days in the market would have lowered ending wealth by approximately $520,000—a shortfall of 60% relative to what they could have if they had just stayed invested.

Of course, the flipside is the potential excess wealth creation from missing the worst days. Though tempting, advisors employing goals-based financial planning understand the additional unpredictability this introduces into the financial planning process.

Figure 4: Strategic asset allocation has historically worked, if you stayed invested

Differences in ending wealth given $100,000 investment in a balanced 60/40 portfolio if missing out on the best (worst) days of performance relative to staying invested for the full period

Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Notes: U.S. stocks as represented by the S&P 500 Index from June 1, 1996 to December 31, 1998, Dow Jones Wilshire 500 Index from January 1, 1999 to April 22, 2005, MSCI US Broad Market Index from April 23, 2005 to June 2, 2013, and CRSP US Total Market Index, thereafter. U.S. fixed income as represented by the Bloomberg Barclays U.S. Aggregate Bond Index from June 1, 1996 to December 31, 2009, and Bloomberg Barclays U.S. Aggregate Float Adjusted Index, thereafter. 60/40 portfolio as represented by a 60% allocation to U.S. stocks and 40% allocation to U.S. fixed income.

Source: Vanguard Investment Advisory Research Center analysis using data from FactSet and Morningstar, Inc. Data as of March 22, 2024.

Make tuning out the noise your investing superpower!

There’s always uncertainty in markets, and fear is a powerful force that is difficult to overcome. However, as advisors, you can flex an even greater power—tuning out the noise.

Tune out the noise, stay invested, and focus on long-term goals.

Higher wealth with less variability—which comes from staying invested and not trying to time markets—increases your chances of financial success.

More and more people are embracing their “tuning out the noise” superpower, as industry asset allocations have exhibited much greater “stay the course” behavior over time.

Don’t be left behind. Make tuning out the noise your superpower!

Footnote 1: U.S. equities as measured by the CRSP US Total Market Index, taxable bonds as measured by Bloomberg U.S. Aggregate Float Adjusted Index (USD), and tax-exempt bonds as measured by S&P National Municipal Index through March 22, 2024.

Notes:

All investing is subject to risk, including possible loss of principal.

Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Diversification does not ensure a profit or protect against a loss. Past performance is not a guarantee of future results.

Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments.