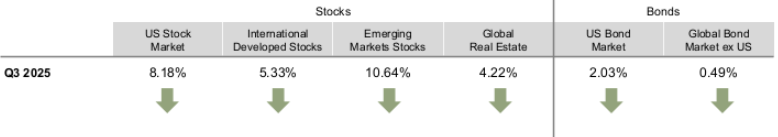

It was a great year in the stock market in the third quarter of 2025. You can see below that the US stocks as a whole rose over 8%, emerging markets were a star at over 10%. And US Bonds, up 2% is a great quarterly result.

Breaking up the US market into small, large, growth and value - small value was the winner at 12.6%. Over the long haul, this is what we expect, but it doesn’t happen each quarter. Small and value were strong in International markets outside the US. In emerging markets, however, dominated by China, growth and large prevailed with growth at 14.0% unhedged.

Want to dig into more detail? See our 15 page Q3 Market Review here.

The O’Reilly Model Portfolios, a diversified mixture of stocks and bonds globally, from 40% stocks to 100% stocks, were up from 3.9% to 7.2% in Q3 2025 and from 9.6% to 15.3% in the first 9 months of 2025.

For Q3, the social models outperformed the standard model by 0.2% to 0.3%, and for the first 9 months of 2025, the social models beat the standard model by 0.9% to 2.7%. We typically expect the social models to slightly underperform the standard models, but over any short time period, any collection of investments can outperform any other collection of investments. There is a lot of noise in performance data, and you need large sample sizes to overcome that noise and make an informed conclusion about performance.

See the details on the standard models here and the social models here.

social models heresocial models heresocial models here