DFA created a wonderful video illustrating the points below:

Original Content posted January 2024: Courtesy content of Apollo Lupescu of Dimensional Fund Advisors. I do not have all the fine print to accompany these numbers but I am confident that the data spans a significant period of time and that the following is an accurate representation of long term market behavior. This is not investment advice.

We are a society of immediate gratification and that makes the market a challenging experience for those watching the market very closely. The market provides long term gratification.

The S&P 500 with its long term historical annualized return of 10% doubles on average about every 7-8 years. It is a proven long term wealth generator. However to experience 10% annualized return one usually needs 20 years of exposure. Only ten years and your annualized return could be significantly lower or higher than 10%. That’s because of volatility which is expected.

The S&P 500, on a daily basis, is up only 53% of the time, which means it’s down 47% of the days. If you watch it that closely, you may not think it is a wealth generator.

S&P 500 - Down 47% of the Market days.

If you only look at your quarterly statements, the S&P 500 is up 71% of the time - that’s much better!

Finally, look at your annual statements and the S&P 500 is up 78% of the time.

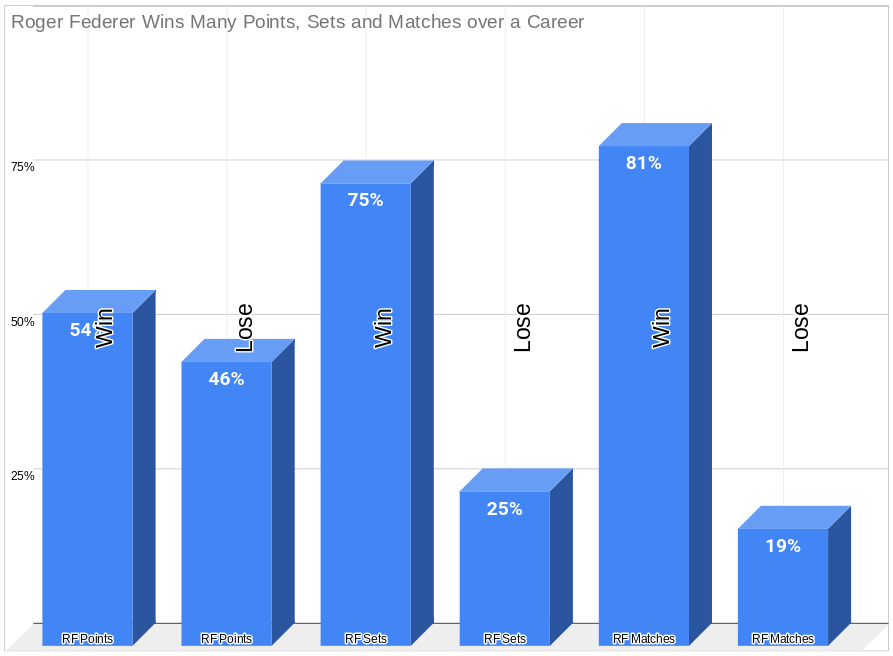

An interesting comparison is sports. Look at the very successful tennis player, Roger Federer. I don’t have his detailed list of accolades to lay out here, but he has won MANY championships and there is no argument that he is an imposing very successful tennis player, on a short list of the best players ever.

Tennis Star Roger Federer - Loses 46% of the points he plays.

Look at each point played, Roger has won just 54% of the points, losing 46%. But if you expand that from points to sets - Roger wins 75% of the sets. Expand one more time to matches and Roger wins 81% of his matches.

If Roger despaired because he wasn’t winning a higher percentage of points, he would never have experienced his incredible career success! Whether investing or playing sports, you have to get in the sport and play many games to build up a winning career. Not playing (investing) means not experiencing the long term success.