As usual I will continue adding details through January as all of us are digesting this last quarter of the year, and the full year. Additional insights may emerge as we dig in and hear others’ viewpoints.

First let us address the economy. Has Chairman Powell and the Federal Open Market Committee engineered a “soft landing”?

That means with the interest rate hikes in 2022-2023, to slow inflation - can we purposely slow down the economy to reduce inflation without slowing it down so much that we enter a recession?

Keep in mind that people spend untold hundreds of thousands of hours debating this. The economy (GDP) is around $27.6 trillion. Let’s say that dipped to $27.55 trillion next quarter and then $27.5 trillion the next quarter. That would be the general definition of a recession. Could you walk down Main Street or Wall Street and make observations that would tell you the economy shrunk by some tiny percentage? I doubt it.

One thing that is generally agreed among the pundits and economists — if there is a recession it will be shallow. In other words, the economy might slow down a bit sometime in 2024 and then rise after that. So what! Have your part of the economy in order. Pay attention to what matters so that you keep your job, maintain your business’ health, spend less than you earn, take care of the most important things - faith, family, friends. Don’t let talk about something totally out of your control impact you.

The jury is still out because it takes an extended amount of time for the interest rate hikes to cascade their impact throughout a gigantic economy. Measuring the impact is also very tricky as some of the measures are delayed. As of now, people expect an economic slowdown to be reached during 2024 - the question is “when”? A related question, will the Fed achieve their goal of 2% or lower inflation rate? Once reached, the Fed can begin to drop rates. One of the odd aspects of all this is that everyone from realtors to investors are cheering for an economic slowdown, because they want interest rate cuts which are positive for most everyone.

It is an established fact that the market moves higher long term, therefore it is inevitable that sometime after a down period, a positive move must happen, That describes 2023 - the inevitable upturn.

Bonds in particular are an interesting story as they are very well positioned after a terrible 2022 that I would label as “a cleansing.” I encourage you to read our blog post about Vanguard’s very positive take on bonds see here,

Return to Sound Money: "Single best economic & financial development in the last 20 years.”

Vanguard is simply saying that bonds producinerg high dividends that are greater than inflation is a very positive and “normal” situation that we haven’t had for 20 years.

We have all of are key resources here for those of you that want to dig in to detail.

Find the Q4 Quarterly and Annual Market Report here.

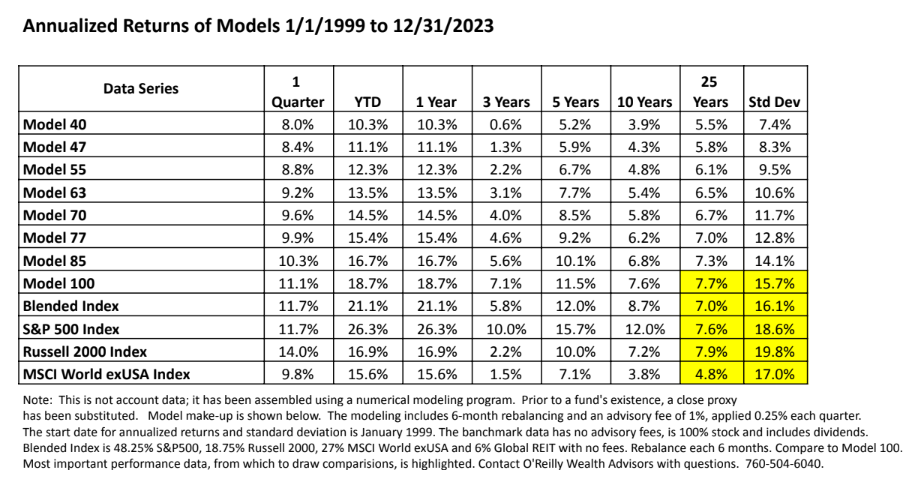

Find the O’Reilly Wealth Advisors Standard Portfolio 2 page performance summary here.

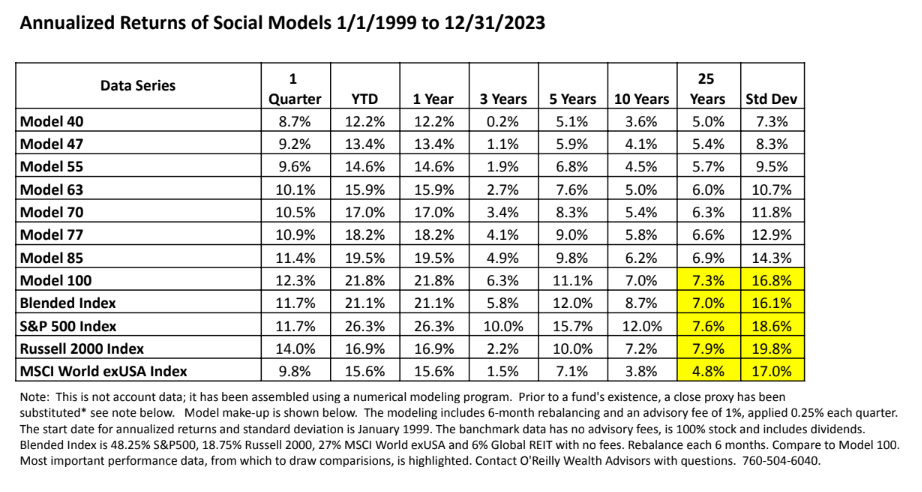

Find the O’Reilly Wealth Advisors Social Portfolio 2 page performance summary here.

Below are screenshots of our standard and social portfolio families’ results. Another unique result we just witnessed is that our social portfolios have outperformed our standard by more than you might expect due to random statistical noise. For example across the year of 2023, the 100% stock social portfolio performed at +21.8% while the standard 100% portfolio was +18.7%!