Content courtesy of Dimensional Fund Advisors.

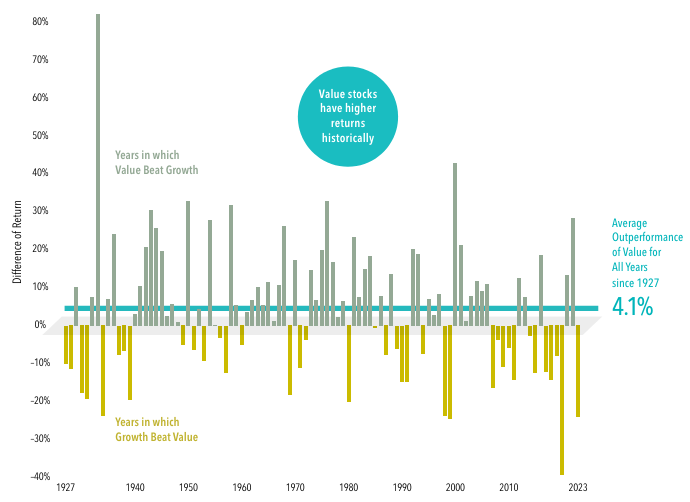

Historically, value stocks have outperformed growth stocks in the US, often by a striking amount.

YEARLY OBSERVATIONS OF THE PREMIUMS

Difference in Return for Value Stocks minus Growth Stocks in US Markets, 1927–2023

Data covering nearly a century backs up the notion that value stocks—those with lower relative prices—have higher expected returns..

Value premiums have often shown up quickly and in large magnitudes. For example, in years when value outperformed growth, the average premium was nearly 15%.

A consistent focus on value stocks is essential to capturing these outsize value premiums when they appear.

Logic and history support a commitment to value stocks so investors can be positioned to take part when those shares outperform in the future.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. In USD. Yearly premiums are calculated as the difference in one-year returns between the two indices described. Value minus growth: Fama/French US Value Research Index minus the Fama/French US Growth Research Index. Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973). Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973). The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Results shown during periods prior to each index’s inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.